Friday, January 19, 2007

Picture of the day

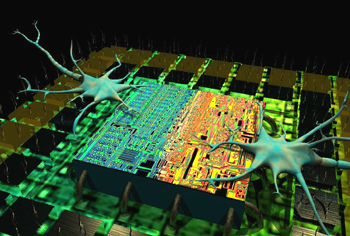

Charles Ostman: This 3D rendering of a neural interface biochip is actually a slide from a 4 1/2 minute animation created at the AAC (Academy of Art College) in San Francisco, as part of a visualization project roughly based on portions of a book I have been developing. This animation was eventually shown at SigGraph, on PBS televsion, and has been incorporated in related content for events in the US, Europe, and Asia. (click to see full sized version)

Special thanks to Kevin Cain, then the director of computer graphics animation at AAC, and the spectacular efforts of over 30 students and fellow instructors who worked for approx. 9 months to create this production. Rendered in Maya 3D, and a variety of other rendering applications.

Visit his Evolution into the Next Millennium site.

As with previous pictures, I will post the others in this series over time. To see it all now, visit the Nanotechnology Now Gallery.

Quote of the day

"Nanotechnology, over the course of the next decade, will create a lot of new wealth, and it will also destroy a lot of old wealth - by rendering old businesses as well as business models obsolete. It will not do these things overnight. Instead, it will do so incrementally. As such, now is the time for prudent investors to begin familiarizing themselves with nanotechnology."

~Jack Uldrich link

"A major environmental, medical or safety problem-real or bogus-with a product or application that's labeled 'nanotechnology'- whether it actually is nanotechnology or not-could dampen public confidence and financial investment in nanotechnology's future, and could even lead to unwise regulation. We should not let this happen."

~Neal Lane, former science advisor to U.S. President Bill Clinton

"One of the exciting yet challenging aspects of nanotechnology investing is the rich variety of opportunities -- from new tools that are essential to some aspect of getting a nanotechnology to market in the near term; to materials that disrupt the economics of a market that is large today; to the really cool science that may have a commercial application some day."

~David Aslin, a West Coast partner at 3i link

"With instruments and tools, investors must identify those companies pursuing markets large enough to generate great returns - typically more than the research market. With bulk nanomaterials, it is all too easy to fall into the commodities trap. Investors must identify and bet on those companies in the value chain that are in a position to capture the lion's share of the value-added that their products and technology create."

~Norm Wu, Managing Director of Alameda Capital link

~Jack Uldrich link

"A major environmental, medical or safety problem-real or bogus-with a product or application that's labeled 'nanotechnology'- whether it actually is nanotechnology or not-could dampen public confidence and financial investment in nanotechnology's future, and could even lead to unwise regulation. We should not let this happen."

~Neal Lane, former science advisor to U.S. President Bill Clinton

"One of the exciting yet challenging aspects of nanotechnology investing is the rich variety of opportunities -- from new tools that are essential to some aspect of getting a nanotechnology to market in the near term; to materials that disrupt the economics of a market that is large today; to the really cool science that may have a commercial application some day."

~David Aslin, a West Coast partner at 3i link

"With instruments and tools, investors must identify those companies pursuing markets large enough to generate great returns - typically more than the research market. With bulk nanomaterials, it is all too easy to fall into the commodities trap. Investors must identify and bet on those companies in the value chain that are in a position to capture the lion's share of the value-added that their products and technology create."

~Norm Wu, Managing Director of Alameda Capital link

Investing in Nanotechnologies

The following is an interview I did with Charles E. Harris of Harris & Harris Group (NASDAQ: TINY) in 2002. His answers hold true today and are worth reviewing, especially for those of you considering investing in one or more nanotech companies.

Regarding investing in companies developing nanoscale technologies

Given the vast number of nano-this and nano-that companies, how does one go about investing in a company with real potential?

One should approach small tech including nanotechnology the same way that one picks through the many opportunities in other, more mature areas of venture capital. Although no one has a crystal ball, and it is always difficult to pick the long-term winners in any group of early-stage companies, the same fundamental analysis applies to nanotechnology as to all other fields. Thus ideally, a nanotech venture capital investment should feature a great management team, solid business plan in a large market space that does not involve competing head on with the elephants, and proprietary intellectual property as an organizing principle -- and all at a reasonable valuation! If the investment is past the seed stage, the co-investors should also be first rate.

Do you expect to see the same kind of frenzied investing in nanotechnology as happened with the dotcom boom, or have we learned our lesson?

There will not be the sort of ease of entry into small tech including nanotech that there was into the dotcom companies. The better small tech companies have important intellectual property that typically has been the product of years of government sponsored research. Also venture capitalists are approaching small tech, at least so far, very prudently, because of the telecom and dot com hangover. For investors, small tech including nanotech will be more like biotech than like the dot coms -- there will be waves of relative enthusiasm by the capital markets, but the real progress will continue for decades with some great, enduring business franchises being created along the way.

Is there any one nanoscale technology of special interest to you or your firm?

Obviously we like computer memory and drug delivery, given that we have invested in Nantero and NanoPharma. But we want to be diversified so we are looking at a wide variety of nanoscale technologies, excluding only the really futuristic plays.

Read the rest of the interview here

Charles Harris has served as CEO of H&H since July 1984. Prior to then, he was Chairman of the investment advisory subsidiary of Donaldson, Lufkin & Jenrette, Wood, Struthers and Winthrop Management Corp. He is a trustee of Cold Spring Harbor Labs and of the Nidus Center. He is a graduate of Princeton University, and Columbia University Graduate School of Business.

Harris & Harris Group, Inc.®, is a publicly traded venture capital firm exclusively focused on investing in tiny technology. We use the term, "tiny technology," as MIT uses it—tiny technology encompasses nanotechnology, microsystems and microelectromechanical systems (MEMS). In fact, most of our portfolio companies are utilizing nanoscale-enabling technologies.

H&H Home

Their Portfolio

Regarding investing in companies developing nanoscale technologies

Given the vast number of nano-this and nano-that companies, how does one go about investing in a company with real potential?

One should approach small tech including nanotechnology the same way that one picks through the many opportunities in other, more mature areas of venture capital. Although no one has a crystal ball, and it is always difficult to pick the long-term winners in any group of early-stage companies, the same fundamental analysis applies to nanotechnology as to all other fields. Thus ideally, a nanotech venture capital investment should feature a great management team, solid business plan in a large market space that does not involve competing head on with the elephants, and proprietary intellectual property as an organizing principle -- and all at a reasonable valuation! If the investment is past the seed stage, the co-investors should also be first rate.

Do you expect to see the same kind of frenzied investing in nanotechnology as happened with the dotcom boom, or have we learned our lesson?

There will not be the sort of ease of entry into small tech including nanotech that there was into the dotcom companies. The better small tech companies have important intellectual property that typically has been the product of years of government sponsored research. Also venture capitalists are approaching small tech, at least so far, very prudently, because of the telecom and dot com hangover. For investors, small tech including nanotech will be more like biotech than like the dot coms -- there will be waves of relative enthusiasm by the capital markets, but the real progress will continue for decades with some great, enduring business franchises being created along the way.

Is there any one nanoscale technology of special interest to you or your firm?

Obviously we like computer memory and drug delivery, given that we have invested in Nantero and NanoPharma. But we want to be diversified so we are looking at a wide variety of nanoscale technologies, excluding only the really futuristic plays.

Read the rest of the interview here

Charles Harris has served as CEO of H&H since July 1984. Prior to then, he was Chairman of the investment advisory subsidiary of Donaldson, Lufkin & Jenrette, Wood, Struthers and Winthrop Management Corp. He is a trustee of Cold Spring Harbor Labs and of the Nidus Center. He is a graduate of Princeton University, and Columbia University Graduate School of Business.

Harris & Harris Group, Inc.®, is a publicly traded venture capital firm exclusively focused on investing in tiny technology. We use the term, "tiny technology," as MIT uses it—tiny technology encompasses nanotechnology, microsystems and microelectromechanical systems (MEMS). In fact, most of our portfolio companies are utilizing nanoscale-enabling technologies.

H&H Home

Their Portfolio

Subscribe to:

Comments (Atom)